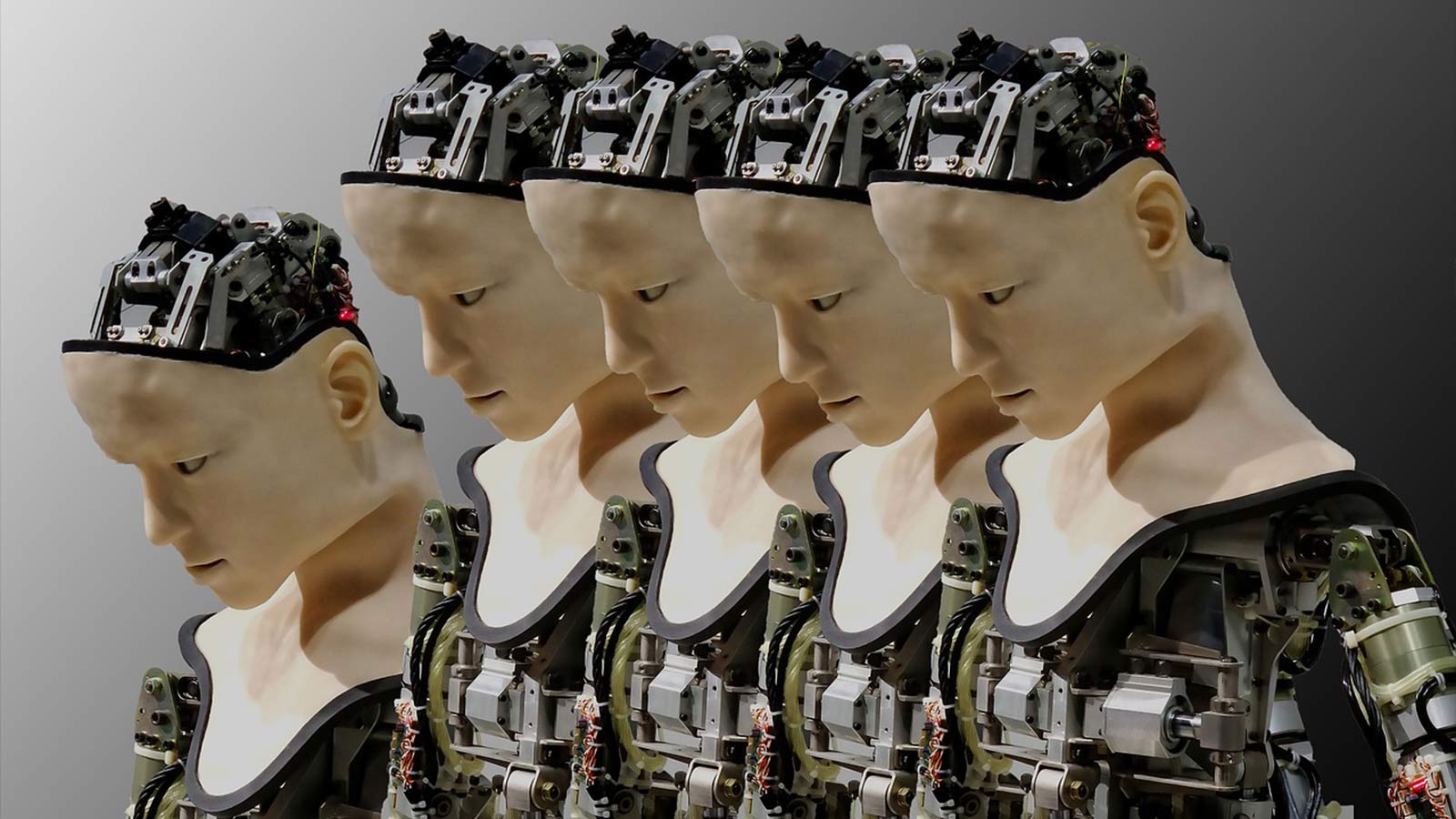

Synthetic intelligence could also be pushed by algorithms and code, however its {hardware} spine is dependent upon gold and silver — the identical treasured metals that join each chip, circuit board and knowledge hub worldwide. World reserves of those supplies are tightening at the same time as industrial demand accelerates, making a structural imbalance few foresaw. Silver stays unmatched because the important conductor embedded in photovoltaic cells and high-speed digital networks, whereas gold continues to function the corrosion-resistant benchmark for bonding wires, connectors and precision elements. In accordance with the World Gold Council, know-how demand for gold reached roughly 326 tonnes final yr, a 7% year-over-year improve, translating to greater than 10.5 million ounces consumed throughout electronics and industrial functions. As AI infrastructure expands worldwide, that urge for food for conductive metals is projected to rise sharply. Positioned to fulfill this rising want, ESGold Corp. (Profile) is advancing a completely funded, absolutely permitted gold-silver challenge engineered for near-term manufacturing and sustained development. The corporate is working to align itself with the evolving ecosystem of producers and finish customers powering the following industrial transformation, together with {industry} leaders akin to Meta Platforms, Tesla Inc., NVIDIA Corp. and Taiwan Semiconductor Manufacturing Co. Ltd.

- ESGold is positioning its flagship Montauban Gold-Silver Undertaking to ship near-term, clear metallic provide with out lengthy allowing timelines, financing gaps.

- The corporate’s up to date Preliminary Financial Evaluation (“PEA”) outlines compelling economics.

- By working with identified, high-grade tailings relatively than exploring from scratch, ESGold eliminates a lot of the uncertainty that sometimes accompanies early-stage tasks.

- Alongside building, ESGold is advancing exploration throughout the Montauban district.

- As AI and renewable infrastructure increase globally, the fabric bottleneck is turning into a defining theme, and ESGold is positioned to deal with it instantly.

Click on right here to view the customized infographic of the ESGold Corp. editorial.

AI Increase Turns Metals into New Bottleneck

Because the digital financial system expands, the constraint is now not software program innovation however the bodily provide of metals that makes trendy intelligence attainable. In accordance with Goldman Sachs Analysis, electrical energy consumption from knowledge facilities is projected to surge by as much as 165% by 2030 in contrast with 2023 ranges, pushed by the fast building of AI-optimized, high-density amenities.

Additionally Learn: AiThority Interview That includes: Pranav Nambiar, Senior Vice President of AI/ML and PaaS at DigitalOcean

This explosive scale-up is cascading by way of provide chains. Each new server, accelerator and swap depends on gold-plated connectors and silver-rich solders, elements whose sturdiness and conductivity rely on these metals’ distinctive traits. The end result will not be a minor adjustment however a full-scale infrastructure transformation that pushes supplies from background prices to headline dangers. When provide tightens, manufacturing can’t wait. Manufacturing traces should proceed, forcing know-how firms to pay premiums to safe crucial inputs.

The indicators of pressure are already seen. Utilities throughout the USA are revising capability plans round surging AI-driven electrical energy demand, whereas analysts warn that international knowledge middle consumption may greater than double by 2030. Within the spot market, stress has flared as nicely: in October 2025, Reuters reported a silver scarcity in London important sufficient to require airlifting bars, sending lease charges sharply greater earlier than stabilizing. For producers, these developments imply urgency, not selection; when gold-plated contacts and silver-bearing solders are important, there isn’t any substitute.

Electronics and renewable vitality sectors are compounding the draw. The World Gold Council stories that know-how demand for gold rose to 326 tonnes in 2024, equal to roughly 10.5 million ounces, whereas the Silver Institute logged industrial silver demand at a report 680.5 million ounces, marking the fourth consecutive yr of structural deficit. Even smartphones are a gradual supply of consumption: Every system accommodates round 7 to 34 milligrams of gold, and with roughly 1.4 billion items produced yearly, they characterize a constant, noncyclical sink earlier than factoring in PCs, servers and networking gear. The result is a tightening supplies stack that more and more dictates the tempo and value of AI, EV and photo voltaic deployment.

Clear, Building-Prepared Provide on Observe

On this tightening panorama, ESGold is positioning its flagship Montauban Gold-Silver Undertaking to ship near-term, clear metallic provide with out the lengthy allowing timelines or financing gaps that delay many mining ventures. The Québec-based challenge is absolutely permitted and absolutely funded by way of building, which is slated for completion in late 2025, with first manufacturing anticipated in 2026. For buyers, that mixture of capital safety, regulatory clearance and visual progress eliminates lots of the customary dangers that hinder development-stage tasks.

ESGold’s technique facilities on reprocessing historic tailings as a substitute of pursuing a standard greenfield mine construct. By leveraging current, mined materials and a confirmed, environmentally accountable processing circuit, the corporate goals to speed up its path to money circulate whereas preserving upside for broader district exploration. Firm updates have detailed ongoing set up and commissioning of a Merrill-Crowe restoration system, alongside an on-site lab and gold room, all tangible milestones that mark the transition from planning to manufacturing readiness.

Funding stability stays a cornerstone of ESGold’s story. A September 2025 replace confirmed full financing to finish Montauban’s buildout and advance a parallel validation initiative in Colombia. In a market the place many junior miners battle for capital, a transparent path to commissioning is a strategic benefit, significantly as industrial and know-how gamers develop extra attuned to supplies safety and dependable provide.

Turning Waste into Worth and Development

ESGold’s enterprise mannequin reverses the standard mining playbook. As an alternative of requiring years of exploration and heavy upfront spending, it generates early income by reprocessing tailings — monetizing materials already extracted — whereas contributing to environmental restoration. The corporate’s up to date Preliminary Financial Evaluation (“PEA”) outlines compelling economics, together with an after-tax inside price of return of about 60%, a payback interval of lower than two years, and an after-tax web current worth above C$24 million at a 5% low cost price based mostly on acknowledged restoration and pricing assumptions.

Whereas PEAs are inherently preliminary, these figures depict a fast-cycling challenge able to reinvesting capital into growth and exploration. That tempo issues in right now’s market, the place {hardware} producers and vitality builders face prolonged provide lead instances. Bringing extra gold and silver to market by 2026 positions ESGold forward of slower-moving friends. Self-funded development additionally provides flexibility: Revenues from tailings can assist step-out drilling or modular capability will increase with much less dilution, strengthening long-term challenge resilience.

Tailings reprocessing aligns neatly with trendy environmental and provide chain priorities. Recovering metals from beforehand mined materials reduces allowing complexity, minimizes new waste, and produces clear, saleable metallic, all attributes more and more valued by downstream consumers. As know-how and renewable vitality firms tighten ESG procurement requirements, the intersection of early money circulate and accountable manufacturing widens ESGold’s potential offtake alternatives.

Scalable Development in a Provide-Constrained Market

By working with identified, high-grade tailings relatively than exploring from scratch, ESGold eliminates a lot of the uncertainty that sometimes accompanies early-stage tasks whereas sustaining upside for discovery throughout the Montauban district. The corporate’s regular building progress on a completely permitted, absolutely financed challenge stands out in a preproduction sector the place many opponents stay years away from income.

Scalability is central to ESGold’s long-term imaginative and prescient. Tailings reprocessing is modular by design; it may be replicated effectively throughout different areas as soon as technical processes are validated. ESGold has indicated its intention to increase this “tailings-to-cash-flow” mannequin all through the Americas, layering in throughput and income whereas protecting danger manageable. This method appeals to each finish customers, who search diversified, verifiable metallic sources, and financiers, who worth repeatable, low-capex unit economics.

Market situations reinforce the chance. Industrial silver demand hit 680.5 million ounces in 2024, its highest degree on report, whereas the worldwide market ran a fourth consecutive deficit. For gold, the World Gold Council attributes technology-related development to AI and electronics. In such an atmosphere, near-term producers with confirmed funding and infrastructure readiness can seize premium pricing and most popular offtake relationships whereas others stay in growth limbo.

Increasing Discovery Throughout Montauban

Alongside building, ESGold is advancing exploration throughout the Montauban district. The corporate stories that its 3D geological modeling program is sort of full, integrating historic and geophysical knowledge to pinpoint deeper, beforehand untapped constructions. Technical research point out steady geological formations extending to about 1,200 meters, suggesting the potential for large-scale mineralization past the tailings useful resource.

Earlier updates cited passive seismic imaging as a key device refining Montauban’s structural understanding. The intent is to evolve from a single-site reprocessing challenge right into a multifeed “hub and spoke” operation sourcing materials from each tailings and new discoveries. ESGold’s parallel progress on allowing ensures drilling can start swiftly as soon as exploration targets are finalized, sustaining operational momentum.

This dual-track method — producing income whereas pursuing exploration — units ESGold aside from friends that should select between near-term money circulate and long-term upside. The Montauban challenge seeks to ship each: fast manufacturing from tailings and the potential for district-scale growth. Even when solely a portion of those deeper zones convert to outlined assets, ESGold’s development runway may prolong nicely past its preliminary working section.

This steadiness, near-term manufacturing with concurrent exploration, differentiates ESGold from juniors locked into long-dated builds. Traders are sometimes compelled to decide on between money circulate and blue-sky upside. Montauban goals to ship each, sequencing income first after which concentrating on scale. If even a part of the deeper goal set converts into assets, the platform for a multiyear district story strengthens. If not, the bottom case stays a permitted, funded operation monetizing tailings in a decent metals market.

Prepared Provide in Tightening Market

Shortage creates alternative. With AI infrastructure, EV manufacturing and photo voltaic deployment all intensifying demand for treasured metals, provide constraints are transferring from a background concern to a central enterprise danger for producers. The Silver Institute’s knowledge confirming consecutive structural deficits, together with spot-market disruptions such because the current London squeeze, illustrate how shortly stock stress can floor when industrial and investor demand converge.

For producers able to including new metallic provide with low capital prices and fast paybacks, these market dynamics favor revaluation as manufacturing nears. Few preproduction firms can credibly declare to be each absolutely permitted and absolutely funded whereas advancing building on schedule. ESGold’s PEA tasks a roughly 60% after-tax inside price of return and a payback below two years, underscoring the challenge’s effectivity. As AI and renewable infrastructure increase globally, the fabric bottleneck is turning into a defining theme, and ESGold is positioned to deal with it instantly.

The broader narrative returns to the core thesis: AI, electrification and renewable vitality are as a lot supplies revolutions as they’re technological ones. Gold and silver aren’t merely safe-haven belongings; they’re important constructing blocks of digital and clear vitality ecosystems. As industrial demand rises and new mine growth stays sluggish, buyers are more and more drawn to firms that may present reliable near-term provide whereas sustaining exploration upside.

ESGold belongs to this choose group. With its Montauban Gold-Silver Undertaking absolutely financed, absolutely permitted, and advancing towards manufacturing in 2026, the corporate provides each stability and scalability. Ongoing exploration provides long-term potential, making a balanced alternative for buyers searching for publicity to the metals that underpin the following technology of know-how and vitality infrastructure.

AI Growth Accelerates as World Leaders Put money into Subsequent-Gen Infrastructure

AI continues to reshape the worldwide financial system, driving unprecedented funding in knowledge infrastructure, computing energy and next-generation manufacturing. All over the world, main innovators are unveiling bold tasks that fuse superior {hardware}, cloud computing and automation to assist the explosive development of AI.

Meta Platforms Inc. (NASDAQ: META) introduced that El Paso, Texas, will likely be house to the corporate’s subsequent state-of-the-art knowledge middle, its twenty fifth in the USA and twenty ninth on the earth. This virtually 1.2 million-square-foot campus will likely be optimized for Meta’s AI workloads as a part of the extremely superior infrastructure that helps join billions of individuals around the globe and can have the power to scale to 1GW. As soon as accomplished, the El Paso Knowledge Middle will characterize an funding of greater than $1.5 billion and assist roughly 100 jobs. The corporate anticipates that greater than 1,800 building employees will likely be onsite on the peak of building.

Tesla Inc. (NASDAQ: TSLA) launched its Grasp Plan Half IV, noting that, because the affect and affect of AI know-how will increase, the mission set forth within the plan ought to come as no shock. “This subsequent chapter will assist create a world we’ve solely simply begun to think about and can accomplish that at a scale that we’ve but to see,” the corporate acknowledged. “We’re constructing the services that carry AI into the bodily world. . . . We’re combining our manufacturing capabilities with our autonomous prowess to ship new services that may speed up international prosperity and human thriving pushed by financial development shared by all.”

NVIDIA Corp. (NASDAQ: NVDA) introduced a landmark collaboration with Oracle to construct the U.S. Division of Vitality (“DOE”)’s largest AI supercomputer to dramatically speed up scientific discovery.

The Solstice system will function a record-breaking 100,000 NVIDIA Blackwell GPUs and assist the DOE’s mission of creating AI capabilities to drive technological management throughout U.S. safety, science and vitality functions. One other system, Equinox, will embrace 10,000 NVIDIA Blackwell GPUs and is anticipated to be out there within the first half of 2026. Each techniques will likely be interconnected by NVIDIA networking and ship a mixed 2,200 exaflops of AI efficiency.

Taiwan Semiconductor Manufacturing Co. Ltd. (NYSE: TSM) unveiled its subsequent cutting-edge logic course of know-how, A14, on the firm’s North America Expertise Symposium. Representing a big development from TSMC’s industry-leading N2 course of, A14 is designed to drive AI transformation ahead by delivering sooner computing and better energy effectivity. It is usually anticipated to boost smartphones by bettering their on-board AI capabilities, making them even smarter. Deliberate to enter manufacturing in 2028, the present A14 growth is progressing easily with yield efficiency forward of schedule.

As AI adoption deepens throughout sectors, the momentum behind these large-scale investments highlights a shift towards sustainable, long-term development constructed on clever infrastructure. Whether or not optimizing vitality techniques, powering analysis or enhancing each day connectivity, the collective progress underscores an interconnected future outlined by the seamless collaboration of human ingenuity and machine intelligence.

Additionally Learn: The Finish Of Serendipity: What Occurs When AI Predicts Each Alternative?